How to Work With a Family Office Without Paying the High Fees?

Are you in dire need of a financial advisor but can’t afford one? Financial services can cost businesses a pretty hefty amount of money. However, you can now avail the expertise of the best just by dialing a number. High Lift Financial will always be at your service!

Traditional family office vs. Matt’s Virtual family office

A traditional family office provides full-service private wealth management advisory services. The primary target market for such a firm comprises ultra-high-net-worth families. An ideal client for such a business is a family with sufficient net worth, a shared vision for investing purposes, and a decent ability to communicate these goals. A family office is beneficial for people as it gives them control regarding how the family office is operated and structured. Family members also have the freedom to aggregate and leverage their assets and overall wealth for better deals.

A traditional family office might offer a host of benefits to its clients, but it has its fair share of challenges. The major drawback is its cost-intensive nature which makes it unaffordable for many market segments, including small and new business owners.

These challenges have given rise to the family office’s new and convenient form- the virtual family office. This relatively new form of advisory management firm ensures a more nuanced degree of outsourcing and keeps the staffing needs low. This, coupled with the low overhead costs, make it a one-stop solution for many more potential clients who necessarily do not belong to affluent families. Now anybody can access a virtual family office from the convenience of their homes, saving cost and time.

Gap identified

With the skyrocketing rate of data use and digital functionality, virtualization has made it crucial for future-proofing the traditional family office. According to a survey, almost 40% of financial institutions are trying to incorporate digital improvements into their business models.

Small businesses face similar financial issues as the larger ones, but the key difference is their inability to access and afford such specialized advisory solutions. With a virtual family office, this problem is put to bed. Other than this, owners of new startups or entrepreneurial projects have limited exposure to potential issues and risks that lie ahead of them. A service like this will equip them and nudge them in the right direction.

Another factor that has made this transition necessary in today’s age is the Pandemic. Not only is this mode of operation necessary for health safety, but the strict regulations have left people with no other option.

Who is Matt DiFrancesco? What is High Lift Financial and how do we help?

Matt has made a mark in the family office and financial consultancy industry with a reputation of a service-centered leader and personality traits like compassion, tenacity, and integrity. With his 15 years of valuable experience and a diverse portfolio, he has successfully built a strong, close-knitted network of professionals and specialists who have helped him bring his business idea to life.

High Lift Financial was founded as your one-stop point of contact for clients belonging to all income groups. The vision of the business is to provide people with a figurehead that will guide them through any financial or business concern. This is where Matt comes in. He plays the role of a fiduciary agent, a financial consultant, and a friend.

The company helps clients in all the important aspects related to their lives and businesses. The company’s few vital services include business planning, monitoring, and road mapping, financial quarterbacking, and ensuring retirement readiness.

Consider High Lift Financial as your 411 when you require guidance and information concerning finance and think of it as your 911 when you come face-to-face with any financial setback.

The Highlift Way

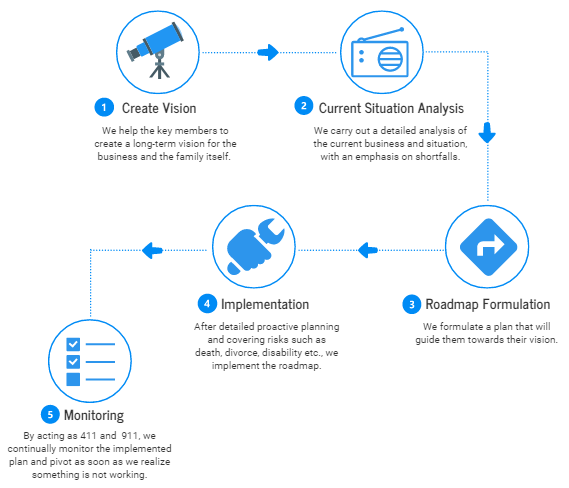

Matt follows a detailed five-step process to analyze the business and family needs to develop a fruitful financial strategy.

The areas that High Lift one-stop-shop covers

-

-

-

- Banking

- Budgeting

- Insurance

- Charitable giving strategies

- Wealth transfer strategies

- Tax services

- Concierge services

- Inheritance tax and succession planning

- Asset management

- Pension and life assurance planning

- Legal services

- Private philanthropy

-

-

How can High Lift Financial help the automotive industry?

The automotive businesses can benefit from this one-stop shop by getting financial strategies tailored to their business and family goals. Matt can provide his extensive expertise as a financial advisor to these clients in wealth management, retirement planning, and long-term investment strategies. Helping automotive financial services is no longer a hassle. Repair your finances today by calling Matt.

Disclaimer

The information compiled and posted here solely represents the opinions and views of the guest. It might not necessarily be similar to the opinions and views of High Lift Financial. The availability of this content only serves educational and informational purposes. It is in no way a substitute for tax or legal advice or professional investment.

Always make sure to consult your financial advisor with any queries related to personal or business planning. DiFrancesco Financial Concierge, LLC. d/b/a HighLift Financial is a Registered Investment Advisor registered with the State of Pennsylvania and subject to the State of Pennsylvania’s regulatory oversight.